Have you noticed that plastic bags are starting to fade away as grocery stores across the nation have planned to discontinue their use? This comes after the plastic straw has lost favor significantly among beverage drinkers, in favor of metal. Are you seeing a trend?

The trend toward environmental responsibility has been championed in no small part by a group of teenagers called VSCO girls.

If you’re reading this post, chances are good that you know what a VSCO girl is, or are one yourself! You may even be wearing 5 scrunchies around your wrist and sipping out of a metal straw as you read this. Given the title of the article, it’s also probably not a stretch to assume you might be interested in creating some of these VSCO fashion accessories yourself.

How to Make a Wrist Scrunchie

Let’s start off with a little relief…you do not need to know how to sew to make this scrunchie! As far as tools go, all you need is a hot glue gun (or some fabric glue).

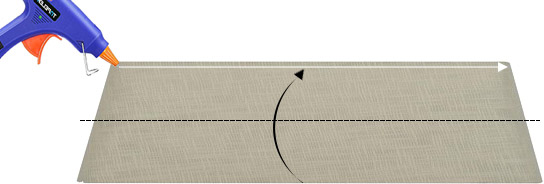

Start off with a piece of fabric about 24 inches wide and 5 inches tall. You don’t have be exact on those measurements.

Add a bead of hot glue (or fabric glue) along one of the shorter sides of the fabric.

Quickly fold the edge over and press down so the glue sticks.

Repeat for the other side. This will ensure that you don’t have frayed edges on your scrunchie.

Now, we’re going to fold the fabric in the other direction, in half and glue it together lengthwise.

And finally slip a piece of elastic through the tube you just created and tie it together at the ends to create a “circle”.

You can use anything for the elastic. Even cut tie together rubber bands or hair ties!

Make Your Own Metal Straws

Making your own metal drinking straws is so easy that you’ll wonder why you’ve never considered it!

I don’t need to bore you with details here! Just buy some round metal tubing and start cutting!

This product is perfect because it’s just slightly wider than a traditional drinking straw, making it perfect for liquid beverages as well as smoothies. And believe it or not, it’s already sized perfectly as a drinking straw at about 9.5″ long. So, you can skip the cutting part and just give them a good wash!

If you are interested in trying out some different materials (brass, for example) or sizes, check out this Amazon search for a list of metal tubing that’ll work.

If you want to get real fancy, you could even pick up a tube bender to give your straw a bit of a drinking angle!

Your comment is awaiting moderation.

[b] DoorDash Background Check: What You Ought to Know[/b]

When signing up to become a DoorDash driver, a crucial step in the process is the background check. This procedure ensures that all potential drivers satisfy the safety and reliability standards established by DoorDash. However, understanding the nuances of this process and knowing how to dispute a background check if errors arise is crucial for applicants.

[b]Background Check Errors[/b]

It’s not uncommon for background check errors to exist. These inaccuracies can range from incorrect criminal records to outdated information. If you find yourself in a situation where you need to dispute background check information, it’s important to act quickly. How to dispute a background check is a common question among applicants, and knowing the correct steps can transform the process smoother.

[b]Disputing a Background Check[/b]

If you find errors, you might wonder, can you dispute a background check? The answer is yes. The first step is to identify the inaccuracies and collect any supporting documents that prove the error. Whether it’s a clerical mistake or an outdated record, understanding how to dispute a failed background check can preserve your application.

For those unsure about the process, consulting a background check lawyer can offer clarity and guidance. These professionals specialize in background check disputes and can help you navigate the complex legal terrain. Knowing how to dispute wrong information on background check reports is crucial, especially when your employment opportunity is at stake.

[b]How to Dispute a Criminal Background Check[/b]

In cases involving criminal records, the stakes are even higher. Learning how to dispute a criminal background check requires a few additional steps. Start by contacting the company that performed the check and detail the discrepancies. They are required by law to investigate your claim. Understanding how to dispute criminal background check information can be daunting, but with the right approach, it is manageable.

Many applicants need to know how to dispute background check information effectively. This includes being clear and concise in your communication and providing ample evidence to support your claim. When you dispute criminal background check details, it’s vital to offer court documents or other official records that contradict the report’s findings.

[b]Steps to Dispute Background Check Information[/b]

Knowing how to dispute something on your background check can make a significant difference. Start by requesting a copy of the report and thoroughly reviewing it for errors. If you find any discrepancies, you need to know how to dispute a background check immediately.

Contacting the reporting agency is the first step in the background check dispute process. Describe the inaccuracies and provide any supporting documentation. Understanding how to dispute a criminal background check specifically might require additional steps, such as obtaining court records or other legal documents.

In conclusion, while the background check process can seem overwhelming, knowing how to dispute background check information can help you resolve any errors swiftly. Whether you’re dealing with minor inaccuracies or significant discrepancies, taking the right steps ensures your application remains in good standing.

[i][u][b]Learn more: https://ig-tchad.org/doordash-background-check/%5B/b%5D%5B/u%5D%5B/i%5D

Your comment is awaiting moderation.

Mistakenly Identified as Deceased by TransUnion: An Increasing Concern

Mistakes in credit reporting can have very negative effects. One of the most alarming errors people may encounter is having their credit bureaus, such as **TransUnion**, mistakenly report them as dead. This significant issue can have a significant harmful impact on everything from employment opportunities to credit applications. It is imperative in such circumstances to know how to dispute a background check and to negotiate the complications of credit report disputes.

### Understanding the Problem

Imagine learning you are incorrectly listed as deceased on your credit record. This is not an unusual situation, however. People in this position must move swiftly to correct it. One key first step can be to contact a background check lawyer or a deceased on credit report lawyer. Experts in background check errors, these professionals can provide the advice you need to fix your credit report.

How to Contest a Background Check

Knowing how to dispute a background check becomes essential when confronted with such a major mistake. Reach out to the credit bureau that made the error first. You must prove your ID and demonstrate you are still alive. Utilizing marked as deceased on credit report lawyers can speed up this sometimes challenging process. These professionals can guarantee your case is handled efficiently and walk you through the intricacies of a background check dispute.

The Role of Attorneys in Resolving Credit Report Errors

Particularly valuable is engaging with my credit report says I’m deceased lawyers. These legal professionals focus in detecting and correcting severe mistakes on credit reports. They can represent you in dealings with credit bureaus and other relevant parties to ensure your problem is taken seriously and fixed promptly. Taking into account their experience in background check disputes, they are well-versed with the legal routes available to rectify such errors and can offer effective counsel if needed.

Preventing Future Errors

When the error is fixed, steps must be taken to prevent it from recurring. Frequently inspecting for errors in your credit report can help find problems early on. Active credit monitoring and knowing how to dispute a background check can help safeguard against potential mistakes. Should errors appear, acting swiftly to **dispute a background check** can reduce the effect of these errors on your individual and monetary life.

In conclusion, it can be troubling when TransUnion reports you as deceased. However, with the right approach and support from knowledgeable specialists like a background check lawyer, persons can manage the procedure of contesting these errors and regaining their creditworthiness.

Learn more: https://bucceri-pincus.com/experian-deceased-alert-showing-deceased/

Your comment is awaiting moderation.

Mistakenly Identified as Deceased by TransUnion: An Increasing Concern

Mistakes in credit reporting can have very negative impacts. One of the scariest errors people may face is having their credit bureaus, such as **TransUnion**, mistakenly report them as dead. This grave error can have a significant detrimental impact on everything from career chances to credit applications. It is crucial in such cases to know how to dispute a background check and to navigate the complications of credit report disputes.

### Understanding the Problem

Imagine finding out you are mistakenly listed as deceased on your credit record. This is not an uncommon situation, however. Persons in this situation must act swiftly to correct it. One important first step can be to contact a background check lawyer or a deceased on credit report lawyer. Professionals in background check errors, these professionals can provide the guidance you need to fix your credit report.

How to Contest a Background Check

Knowing how to dispute a background check becomes vital when confronted with such a significant mistake. Reach out to the credit bureau that made the error first. You must prove your identification and show you are still alive. Using marked as deceased on credit report lawyers can accelerate this sometimes daunting process. These experts can ensure your case is managed efficiently and lead you through the complexities of a background check dispute.

The Role of Attorneys in Resolving Credit Report Errors

Notably helpful is working with my credit report says I’m deceased lawyers. These attorneys focus in identifying and resolving serious mistakes on credit reports. They can advocate for you in interactions with credit bureaus and other relevant parties to make sure your issue is addressed and resolved promptly. Considering their expertise in background check disputes, they are familiar with the legal avenues open to fix such errors and can provide effective counsel if required.

Preventing Future Errors

After the error is resolved, measures must be taken to avoid it from recurring. Frequently reviewing for errors in your credit report can help find problems early on. Active credit monitoring and knowing how to dispute a background check can help guard against potential mistakes. Should inconsistencies arise, moving swiftly to **dispute a background check** can reduce the effect of these errors on your private and economic life.

In conclusion, it can be distressing when TransUnion reports you as deceased. However, with the right strategy and support from skilled experts like a background check lawyer, people can navigate the process of contesting these errors and recovering their creditworthiness.

Learn more: https://bucceri-pincus.com/emily-islada-cus/

Your comment is awaiting moderation.

Has it ever happened that your credit report unexpectedly “declares” you dead? Encountering an erroneous death marker in your TransUnion credit report can be a significant ordeal for anyone. This mistake not only creates a sense of anxiety and stress but can also have long-term consequences for your financial life, affecting your ability to obtain loans, insurance, and even employment.

Understanding the Seriousness of the Situation

The erroneous listing of you as deceased in TransUnion’s databases is not just a small oversight. It’s a mistake that can block your access to the most critical financial tools and services. It’s crucial to realize that behind this “digital” problem lie real-life inconveniences and obstacles, such as issues with the social security administration death index and wrongful denial of coverage.

Statistical Insight

Let’s consider some statistics that illustrate the prevalence of the problem. For instance, credit bureau reports deceased and social security administration death notification errors occur frequently. Experian death notification and Equifax death notice errors are also common.

These figures underscore the importance of timely detecting and correcting such errors. If you find your credit report says I am deceased or your credit report shows deceased, immediate action is required.

Benefits of Choosing Our Law Firm

Choosing our company to solve your problem with your credit report is a choice in favor of professionalism and reliability. Thanks to deep knowledge of the FCRA law and experience in handling similar cases, we offer you the following benefits:

No expenses for you: the costs of our services are borne by the respondent.

Hundreds of satisfied clients and million-dollar compensations confirm our effectiveness.

We take on all the work of interacting with credit bureaus and protecting your interests.

Real-Life Problems Encountered by People

Mistakenly reported as deceased TransUnion – denials of credit and financial services.

Credit report is showing deceased TransUnion – problems with insurance applications and insurance company refusal to pay.

Flagging TransUnion account as deceased – difficulties with employment due to background check errors.

TransUnion deceased alert – inability to sign financial contracts, leading to insurance claim denial and long-term care claim lawyer consultations.

These issues not only create financial and emotional difficulties but also undermine your trust in the credit monitoring system. When errors like a deceased indicator on credit report occur, it’s essential to have an experienced insurance attorney on your side to navigate the complexities.

Have you been mistakenly reported as deceased on credit report? Are you dealing with a social security number reported as deceased or credit report deceased errors? Our firm specializes in resolving these issues, ensuring your records are corrected swiftly. Contact us to enforce insurance promises and get your financial life back on track.

If your credit report says I am deceased, don’t wait. Our experienced team can help you prove you are not deceased and address inaccuracies such as deceased indicator meaning and credit bureau reports deceased. Trust us to handle your case with the dedication of a skilled insurance lawyer.

https://bucceri-pincus.com/experian-deceased-alert-showing-deceased/

Your comment is awaiting moderation.

mostbet

jojobet

casibom

jojobet giris